How Home Care Helps Protect Seniors During Flu Season

This time of year, it is especially important for older adults to receive the flu vaccine. The flu...

This time of year, it is especially important for older adults to receive the flu vaccine. The flu...

Supporting a loved one who needs care often comes naturally and stems from kindness; however,...

Most of us don’t think of the brain the same way we think of the heart or lungs, but it is an...

Top Questions to Ask When Interviewing a Home Care Company in Boston The Key to Finding Safe,...

Home health agencies are the silent champions of the healthcare system, as they provide medical...

It is estimated that about 77% of adults who are 50 and older wish to live independently within the...

Reiki benefits Dementia Patients and Caregivers . . . really everyone can benefit from Reiki.

Dementia is a complex disease that affects both the patient’s and the family’s well-being. It is a...

As our parents grow older, we all become concerned about their health and the quality of their...

While many of us are anxiously waiting for all the well-deserved rest in retirement, this time can...

Dealing with the news that your parent has been diagnosed with a long-term, progressive decline in...

In the long term, hip replacement surgery almost always improves mobility and quality of life....

A fall in the home for an older adult can result in a serious, potentially life-threatening injury....

When looking for information about Alzheimer's and dementia, reading just a few selected blogs can...

Sudden illness or a major medical incident, such as a heart attack, can be a huge shock for an...

Caring for someone with Parkinson's Disease can be a full-time job. It's important to know that,...

End-of-life care is an approach in healthcare that offers comfort, support, and dignity to...

It is important to understand what are the differences between different forms of late-stage care...

If your dad is recovering from a major stroke, he could be at a heightened risk of depression. When...

It can be emotionally draining to navigate a loved one's complicated dementia path, particularly if...

If your family is struggling with the consequences of a loved one's mini-stroke, the journey ahead...

1-resized-600.jpg)

Many of us have parents who live alone, and we’re always concerned about their safety. What if they...

Massachusett's first lady, Diane Patrick spoke in front of more than 500 attendees at the Schwartz...

National Falls Prevention Awareness Day is observed the first day of fall to promote and increase...

This article was submitted to us by the Law Office of Amy Antonellis.

Here are some tips for good senior nutrition, just in time for National Nutrition Month! Go to...

Having a conversation with your mom or dad about Home Care can be hard for them, and uncomfortable...

There are some conversations we know are inevitable, but which we dread, and one of these is...

When you take on the role of family caregiver for a loved one, it can be difficult to admit that...

Research has shown that pet therapy is an effective way to improve the mental, physical, and...

Long life spans are no longer the exception to the rule, but the rule itself. According to a...

Falls are the leading cause of injury in older adults and often result in hip fractures, brain...

According to the Alzheimer’s Association, depression is very common in dementia sufferers,...

The experience of having a loved one suffer from dementia brings about a type of grief that does...

Agitation, aggression, and unpredictable behavior caused by cognitive issues can make being a...

This article was initially taken from Yahoo Health in 2011 and updated over the years. You can also...

When someone has a stroke, it can be a huge shock, not only to the person in question, but also...

When your parent has a stroke, it can be a huge shock, not just for them but for you too, and...

Stress, exhaustion and burnout are extremely common for family caregivers who spend time providing...

The ability to complete everyday tasks for ourselves, such as bathing, dressing, eating, even...

Choosing the right Home Care company is a big decision - especially if your parent has Parkinson’s...

Work, kids, relationships, and now an elderly parent who requires near full-time care at home; life...

Taking care of an elderly parent is a big responsibility that has the power to completely change...

If Mom or Dad can no longer live safely at home on their own, you may have already thought about...

While the physical symptoms of Parkinson's disease, such as muscle rigidity and tremors, are well...

Parkinson's Disease manifests differently in each individual, but there are some consistent...

If you're currently spending time at your mom’s house over the holiday season or have just returned...

Caring for a loved one is an admirable, but also exhausting and challenging, role to take on. Many...

Your mom is ready to be discharged from the hospital, but what do you do when you, and your elderly...

Making the decision to get help with the care of your elderly parent is a big and important step....

Multiple Sclerosis is a progressive neurological condition that affects a person's mobility....

Learning that your elderly parent cannot live independently anymore can be a terrifying moment,...

If your parent has received a late-onset Multiple Sclerosis (MS) diagnosis, it's essential to...

Mobility issues, fragility, forgetfulness and loneliness; watching your parent age can be very...

Every month the Ezra Home Care team invites certified professionals in geriatric care to provide...

For many older people, there comes a time when it is no longer safe or possible for them to live...

Increasing protein intake helps prevent muscle decline which helps prevent falls but many elderly...

As our parents grow older, their needs can change and become more challenging, affecting the...

For many seniors and individuals with temporary or permanent disabilities, dressing can be a...

If a loved one is diagnosed with ALS, their life, and the lives of their family members, will...

Diabetes can cause health complications, but people can stay safely in their homes with proper care...

Stopping age-related muscle loss What are some good ways to halt and reverse age-related muscle...

Frosty temperatures and icy streets can make it difficult for your elderly parent with mobility...

Realizing that your elderly parent can no longer safely drive can be difficult. Driving is often a...

One in three seniors aged 65 and over suffer a fall every single year, according to a report by the...

Life expectancy is on the rise, but so too is the number of US citizens suffering from Type II...

Since slips and falls are a major source of injuries, it is necessary to prevent them within the...

Live-in home care is a form of assistance which involves a caregiver staying in the client's home...

Making decisions about care options in the final stages of life can be overwhelming. This is why it...

There are many different types of dementia, so it is important to understand the differences, and...

If the somewhat daunting term 'Electroshock Therapy' has been recommended by your loved one’s...

Accepting that a loved one is running out of time is a very emotional experience, especially when...

If a loved one has been diagnosed with dementia, as the family caregiver, you will need to...

One in five people over the age of 55 will experience a mental health issue, according to the...

One of our clients, Betty (1) is 85 years old. As with many of our older clients, she has many...

Home Care is Helpful Care for Diabetics Neglecting to care for your diabetes, or your loved one’s...

Thanksgiving is a big day when it comes to feasting and if you are a diabetic, it might be...

As the stages of our lives go by, most of us will find ourselves ready to downsize. Whether we move...

Heart disease is the No. 1 killer of Americans. Experts tell us that we may reduce heart disease by...

Bill Bradley had difficulties of getting out of his car. Now this task is much easier for him...

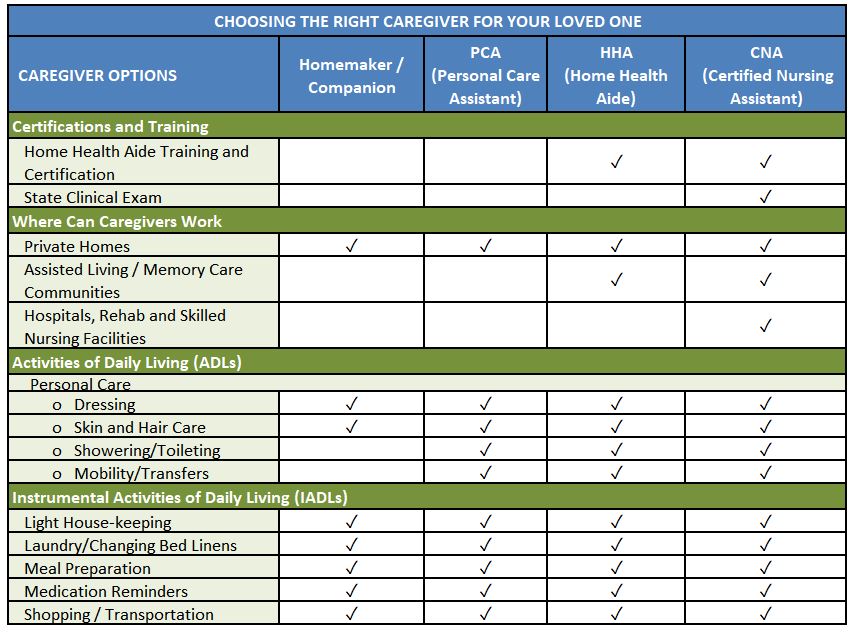

Hiring a caregiver for assistance with activities such as bathing, dressing, eating, transferring...

Exploring the link between diet and brain health is a key area of modern research in regard to...

For years, she gave you life advice, but now she can barely remember the days of the week. How do...

Tip #1: Understand what options are available

Be Your Own Health Care Advocate

Marcela del Carmen, MD, gynecologic oncologist at the Massachusetts General Hospital Cancer Center,...

October 29th and 30th don’t miss an inspirational TV Show “Don’t Retire, Inspire” on BNN. The Show...

If you're currently undergoing treatment for breast cancer or have been treated for breast cancer...

Can driving continue after a person has been diagnosed with dementia? As a general rule, people...

What will happen with home care in the future? Learn about 5 new technologies created over the last...

Navigating through your dad’s Alzheimer’s journey can be difficult, especially because there are so...

THINKING POSITIVELY All of our feelings, beliefs and knowledge are based on one thing: our internal...

Long-term care insurance pays for services that aren't covered by Medicare or traditional health...

Family members can be overwhelmed when entering a completely new world of caregiving, and being...

June is dedicated to Post Traumatic Stress Disorder Awareness. At Ezra Home Care, we provide care...

Ensure happier holidays for seniors with special needs or health issues If you have older friends...

Senior hoarding seems to be have been around for a very long time. Recently, we hear more about...

What are you thankful for as a caregiver? The help of others? The miracle of patience? The grace of...

Dealing with your parent’s dementia diagnosis can be a challenging time, and it can feel extra...

Ezra Home Care's Holocaust Survivor Program was featured on television! Jessica Zelfand and...

When someone you love has dementia, their behavior is likely to change, and sometimes conversations...

This article was submitted by guest blogger, Bryan Agurcia (*)

If you are going to hire a caregiver or a home care company to care for your loved one, it is...

In the heart of Manhattan, two wealthy brothers, Homer and Langley Collyer, lived trapped by...

Ezra Home Care interviewed an accountant/tax adviser, Lev Agranovich, about tax deductions for home...

Labored breathing, surgical infection, and uncontrolled pains have been some of the reasons for...

As many as one in five of the senior population in the US suffer from at least one mental health...

Ezra Home Care recently interviewed Carol Westheimer, a specialist in the field of geriatrics,...

New Survey Studies Financial Wellbeing of Senior Living Residents This article is from the ALFA...

As the winter months get closer, and the weather turns colder, windier and drier, your skin will...

Pride, fear, not accepting the facts of aging - these are just some of the reasons behind an older...

At some point our loved ones may need assistance with daily living activities or other kind of...

Everyone looks forward to a restful night’s sleep. This is the time our body uses to restore and...

2.jpg)

Randy Veraguas is an extremely positive person. Her favorite quote is: “Every cloud has a silver...

By Paula Spencer Scott, Caring.com senior editor

Being at the receiving end of increasingly bad behavior from an elderly parent with cognitive or...

Home care for ALS patients is a type of care that is provided in the patient's home by trained...

Amyotrophic Lateral Sclerosis (ALS) is a scientific mystery. Despite the extensive research, the...

Although Amyotrophic Lateral Sclerosis (ALS) progresses differently in each individual, it usually...

For individuals diagnosed with Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s...

The prevention of Amyotrophic lateral sclerosis (ALS) is being actively researched. While there is...

Get insight into choosing healthcare providers, aging and health resources, research data and more...

Scientific sources usually refer to three major stages of ALS (Amyotrophic lateral sclerosis) -...